Zamestnaní

Róbert Gálik, krajský riaditeľ

Môžeš sa nám krátko predstaviť? Kto si a z akej oblasti prichádzaš?

Som krajský riaditeľ. Predtým som pracoval v IT sfére a v gastronómii.

Akú prácu si vykonával predtým (pozícia, odvetvie, zodpovednosti)?

V gastronómii som začínal vo fastfoode – od upratovania, cez obsluhu až po manažovanie ľudí na smene. V IT oblasti som pracoval v predaji komponentov cez telefón.

Čo ťa na tejto práci bavilo a čo ti, naopak, chýbalo?

Vo fastfoode som vďačný najmä za to, že ma naučili systému a efektivite. Chýbala mi však voľnosť a sloboda byť sám sebe pánom. Smennosť, nočné služby a príjmy mi neumožňovali budovať život, aký som chcel. V IT oblasti mi chýbala opäť najmä sloboda a jasne nastavená kariéra závislá od výsledkov, nie od nálady nadriadeného.

Ako si sa prvýkrát dozvedel o finančnom sprostredkovaní/MLM?

Spočiatku som využil služby ako klient, pretože som sa v oblasti financií nevyznal. V banke ani v poisťovni som nedostával informácie, ktoré by pomohli mne – skôr som mal pocit, že pomáhajú hlavne im.

Čo bolo tým impulzom, že si začal uvažovať o zmene?

Presne to, čo mi chýbalo – sloboda, vyššie príjmy a kariéra založená na výsledkoch. Veľkým lákadlom boli aj teambuildingy, dovolenky a možnosť cestovať po svete s kolegami i rodinou.

Mal si nejaké obavy alebo predsudky? Ako si ich prekonal?

Som človek, ktorý sa sústredí na pozitíva a výzvy. Odmietal som predstavu, že by išlo len o „predaj a presviedčanie“. Kedysi takto fungovalo veľa ľudí. Dnes je to iné – finančné služby prinášajú skutočné benefity a kariéra v tejto oblasti má množstvo výhod.

Ako vyzerali tvoje začiatky?

Jednoducho som o tom hovoril každému. Negatívni ľudia hľadajú dôvody, prečo sa niečo nedá. Pozitívni sa nadchnú a posúvajú sa vpred. Pre pozitívnych ľudí je tento odbor ideálny.

Aké bolo porovnať manažérsku prácu v korporáte a začiatky tu?

V korporáte som bol najskôr podriadeným, neskôr nadriadeným, no stále zároveň niekoho podriadeným. Tu je to iné – sme mentormi, dávame ľuďom šancu zmeniť svoj život a je na nich, ako veľmi chcú. Niektorí si len privyrábajú, iným rastie príjem z roka na rok dvojnásobne.

Na čo si dnes najviac hrdý?

Na kolegov, rodinu a na seba. Najviac ma teší, keď vidím, ako sa mladí ľudia dokážu posúvať vpred, ak majú otvorenú myseľ a chuť rásť. No ešte viac ma hreje pocit, že moje deti sú na mňa hrdé a berú ma ako vzor.

Čo ti tento biznis priniesol (časová voľnosť, financie, osobný rast…)?

Prakticky všetko, okrem cieľov, ktoré mám ešte vo víziách a ktoré si splníme v budúcnosti. Prvých päť rokov som zabezpečil rodinu, potom krásny dom a rýchle auto. Následne sme sa pustili do veľkého projektu – rozhodli sme sa zachrániť kaštieľ v Jablonici na Záhorí, aby sme vrátili niečo aj komunite.

Ako sa zmenil tvoj životný štýl oproti korporátu?

Najviac som získal slobodu – pracujem, kedy chcem, a svoj čas si určujem sám. Cestujem veľa s kolegami aj s rodinou, čo by v korporáte nebolo možné. Finančné ciele, ktoré v korporáte väčšinou končia pri byte, aute a jednej dovolenke ročne, som posunul oveľa ďalej.

Prečo by si dnes opäť urobil to isté rozhodnutie?

Pre všetky vyššie spomenuté dôvody. Keďže som nemal milión eur na podnikanie, toto bola jediná možnosť, ako začať od nuly, dosiahnuť niečo a zároveň sa naučiť pracovať s financiami vo veľkom.

Čo by si poradil človeku, ktorý je dnes na manažérskej pozícii, ale cíti, že to nie je „ono“?

Otvor si zadné vrátka a odbúraj strach zo straty. Môj manažér v IT mi raz povedal: „Niekedy musíš spraviť päť krokov dozadu, aby si následne urobil sto krokov vpred.“ Vtedy si ani neuvedomoval, čo tým vo mne spustil.

Aké motto alebo myšlienku by si odkázal tým, ktorí rozmýšľajú nad začiatkom?

Za vyskúšanie nič nedáš – u nás nepotrebuješ vstupný kapitál. Mám kamarátov, ktorí začali podnikať, investovali úspory, požičali si peniaze a napokon skrachovali. V čase pandémie takých pribudli desiatky. Skončili späť v korporátoch s pocitom, že podnikanie je ťažké. Nie je! Len treba mať správneho mentora, ktorý ťa posunie vpred.

How do I qualitfy for our

Payday Loan lender service?

To qualify for our payday loan lender service, we consider a few key factors to ensure a streamlined and transparent process. Our goal is to provide access to financial assistance for those facing temporary cash flow challenges. Here are the typical qualifications you'll need to meet:

Steady Employment or Verifiable Income Source

Minimum Age Requirement (typically 18 years or older)

Active Checking Account for Direct Deposit

Proof of Residence and Valid Government-Issued ID

How do I qualitfy for our

Payday Loan lender service?

To qualify for our payday loan lender service, we consider a few key factors to ensure a streamlined and transparent process. Our goal is to provide access to financial assistance for those facing temporary cash flow challenges. Here are the typical qualifications you'll need to meet:

Steady Employment or Verifiable Income Source

Minimum Age Requirement (typically 18 years or older)

Active Checking Account for Direct Deposit

Proof of Residence and Valid Government-Issued ID

Get a Quick Decsion

We understand that unexpected expenses can't be put on hold, which is why our streamlined application process and efficient review system are designed to provide you with a decision promptly. Once you've submitted your online application, our team works diligently to verify your information and assess your eligibility. Within a matter of hours, you'll receive a response, eliminating the stress and uncertainty of a prolonged waiting period.

With our commitment to swift decision-making, you can rest assured that your financial needs will be addressed promptly, allowing you to focus on resolving your pressing obligations without further complications.

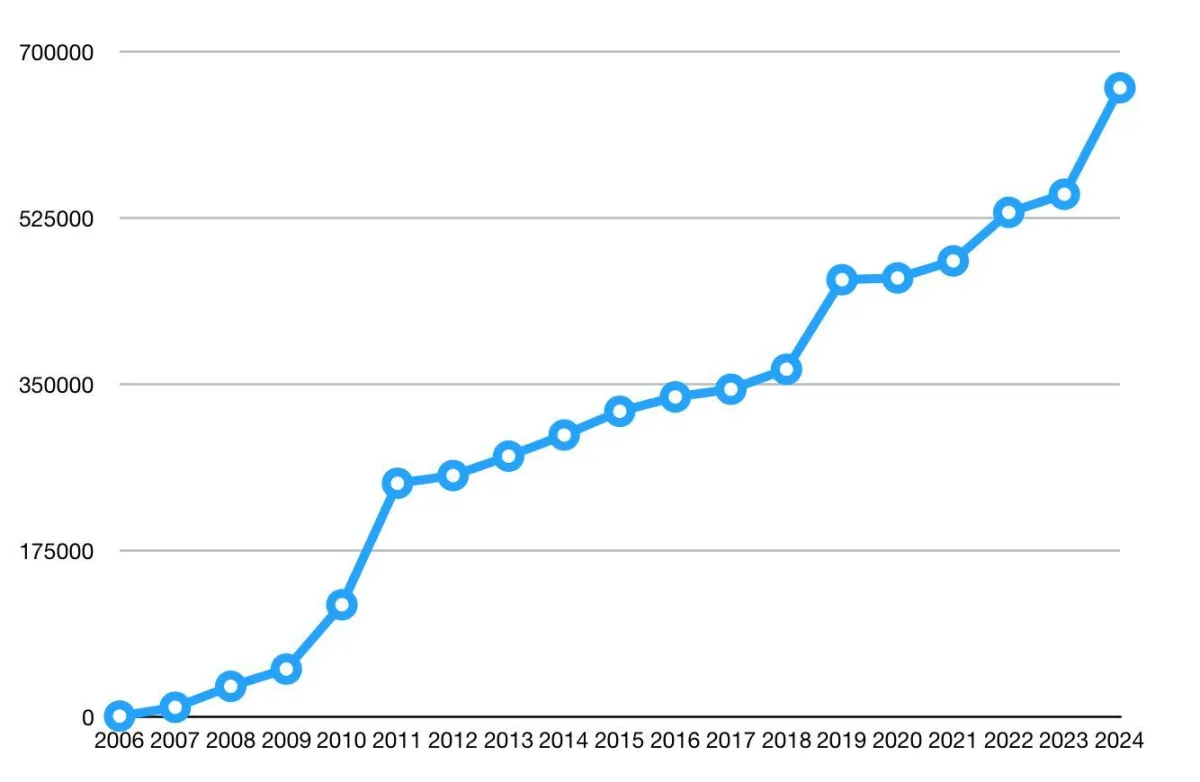

500+

Satisfied Customers

5+

Years of Experiance

20+

Cities Covered

5k

Staff Members

SERVICES LIST

What you will learn with this book

Short-Term Cash Loans

These loans provide a quick infusion of cash to cover immediate expenses until your next paycheck arrives. With relatively small loan amounts and short repayment periods, usually a few weeks, they offer a temporary solution for unexpected bills or cash shortfalls.

Payday Advances

Similar to short-term cash loans, payday advances are designed to bridge the gap between paydays. You can borrow a portion of your upcoming paycheck and repay the advance, plus fees and interest, when you receive your next paycheck.

Cash Loan

A cash advance allows you to borrow money against your credit card's available balance. Payday lenders may offer this service, providing you with immediate cash in exchange for fees and the promise to repay the advance from your next paycheck.

Title Loans (using a vehicle title as collateral)

For those who own a vehicle outright, title loans allow you to use your vehicle's title as collateral for a short-term loan. The lender holds onto your title until the loan, plus interest and fees, is repaid.

Installment Loans

Unlike single-payment payday loans, installment loans from payday lenders are repaid over a longer period through scheduled installments. This can make larger loan amounts more manageable but also increases the overall interest paid.

Check Cashing Services

Many payday lenders offer check cashing services, allowing you to cash personal, payroll, government, or other types of checks for a fee, providing instant access to those funds.

Testimonials

When my car broke down unexpectedly, I was hit with a massive repair bill that I simply couldn't afford. Thanks to the quick payday loan service, I was able to get the cash I needed within hours to fix my car and get back on the road. Their hassle-free process and friendly staff made a stressful situation so much easier to manage. I'm grateful for their help during my time of need.

JOHN DOE

As a single mom, juggling bills and unexpected expenses can be overwhelming. Last month, when I was hit with a higher than normal utility bill, I didn't know how I would make ends meet. Fortunately, the payday lenders provided me with a short-term loan solution that allowed me to keep the lights on until my next paycheck. Their service was confidential, and the process was clearly explained. I can't thank them enough for their assistance during a very difficult time.

JANE DOE

Costs

Loan amount:

$xxx - $xx,xxx

Repayment period:

12 monts - 24 months

Payday loans typically come with relatively short repayment periods, often aligning with your next pay cycle. Many lenders require repayment in full, including the principal amount borrowed plus interest and fees, within 2-4 weeks. The interest rates charged by payday lenders are significantly higher than those offered by traditional banks and credit unions for longer-term loans.

Annual percentage rates (APRs) can range anywhere from 200% to 500% or even higher in some cases. While this makes payday loans an expensive option, the trade-off is quick access to cash for those unable to qualify for more favorable rates from banks. Lenders justify the higher rates as compensation for taking on borrowers with poor or no credit histories. It's crucial to carefully review the terms and have a plan to repay the full amount on time to avoid rolling over the debt and incurring additional fees.

FAQS

How much can I borrow with a payday loan?

The maximum loan amount varies by lender and state regulations, but typically ranges from $300 to $1,000. Many lenders offer smaller sums like $100 or $200 for first-time borrowers or those with limited income.

What do I need to qualify for a payday loan?

While requirements can vary, most lenders require you to be at least 18 years old, have a steady source of income, an active checking account, and a valid form of identification. Some may also consider your credit history but bad credit does not automatically disqualify you.

How long do I have to repay a payday loan?

Payday loans are short-term loans designed to be repaid with your next paycheck, usually within 2 to 4 weeks. Some lenders may offer slightly longer terms of up to 45 days, but the loan periods are meant to be brief until your next pay date.